The most controversial aspect of IEX’s proposed design seems to be the non-uniform application of their speed bump. [1] Before the community invests too much time debating this issue, I want to discuss why the unfair access proposed by IEX is unnecessary. IEX could accomplish their stated goals without offering an informational advantage to its peg orders or router.

Apparently, IEX doesn’t apply the speed bump to incoming market data used for repricing algorithmic order types, or for communications between the exchange and their router. A lot of people (including me) have explained how these disparities can cause problems. In short, repricing algorithmic order types with market data that counterparties haven’t yet seen is equivalent to “latency arbitrage.” And, it feels anti-competitive for IEX to delay communications between itself and every unaffiliated router. [2][3] In this post, I’ll explain why these two exceptions to the speed bump aren’t needed to prevent “latency arbitrage” and “front-running.”

Protecting Peg Orders Without Privileging Them

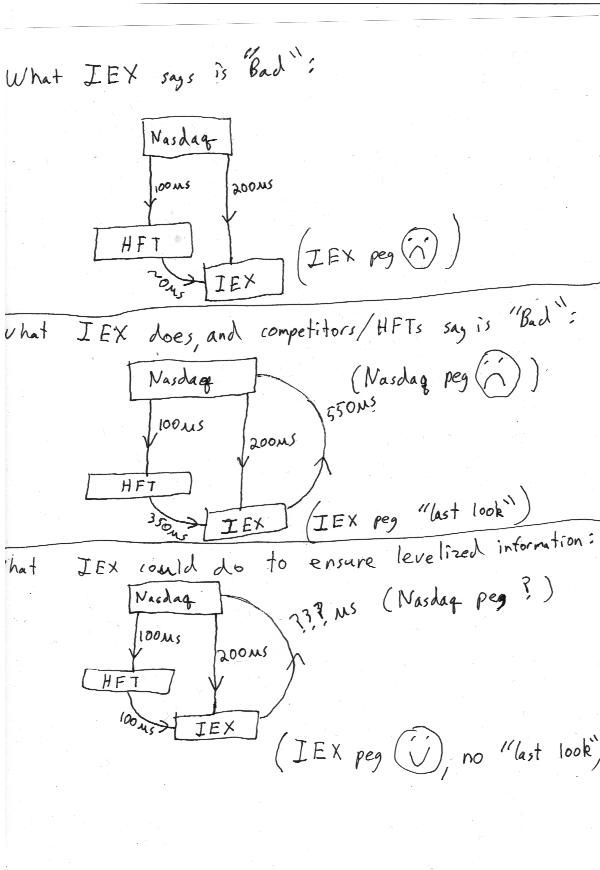

IEX wants to make it impossible for its peg orders to be “picked off” by traders that process market data faster than IEX can. But that doesn’t actually require IEX to reprice its peg orders with fully non-delayed market data. The CME is introducing functionality that timestamps client orders at the moment they are received, then processes them in the order of those timestamps. IEX could do the same, but also timestamp incoming market data. If IEX doesn’t want to subscribe to wireless data feeds, it could subtract the latency difference between wireless and fiber links from its market data timestamps. [4] Once IEX has levelized timestamps for all messages, all it needs to do is process the messages in the correct order. This would accomplish IEX’s goal of “[ensuring] that no market participants can take action on IEX in reaction to changes in market prices before IEX is aware of the same price changes.”

If re-ordering messages with software during the shoebox delay makes the delay appear more “intentional” (which violates Reg. NMS), there are analog options too. [5] IEX could introduce smaller shoeboxes for the direct feeds it processes. For example, if IEX receives market data messages from Nasdaq 200us before any trader can act on them, then it can add a delay coil of 200us to its cable from Nasdaq. And, if it receives market data from NYSE 50us before fast traders do, then it can add a 50us coil to its NYSE feed, etc.

Either of these options would prevent IEX peg orders from being repriced in a “last look”-like manner. Here’s a stylized, bad diagram:

Preventing Information-Leakage from IEX’s Router Without Privileging It

IEX says that it delays outgoing messages to all subscribers, except their routing broker-dealer (IEXS), “to prevent “information leakage” or “liquidity fade” when IEXS routes to other markets.” Their concern is that, without this asymmetric delay, market-makers could pull their quotes on other exchanges if a trader sends a large order to IEX which partially executes before being routed out. However, IEX could prevent that “front-running” [6] by locating its router outside the speed bump in Secaucus, with clients. The router could then maintain its view of exchanges’ visible order books, including IEX’s, and time the sending of its orders so that they arrive at all exchanges simultaneously.

IEX suggests that competing routers could operate in this way, so IEX should be aware that its router could do the same. [7][8] But there is a drawback. The router would only know the visible quantity posted on IEX, and wouldn’t be able to optimally interact with IEX’s hidden orders. The only way a router can fully access hidden liquidity at a given exchange is by operating sequentially: first sending an order to that exchange, waiting to hear back, then sending any unfilled balance to other markets. The whole point of hidden liquidity is that you only know it’s there after you (or others) trade with it. [9]

By allowing its router to bypass the speed bump, IEX effectively gives it exclusive access to IEX’s hidden order book information. That special access only lasts for the speed bump duration of 350us, but it still seems problematic. Lava was fined for allegedly using information from its hidden order book to help routing decisions at an affiliate. Matt Levine argues that this offense was (mostly) victimless:

What ColorBook did with the hidden orders is route its customers to those hidden orders… Once they submitted an order to buy X shares at Y price, ColorBook would send it toward the hidden orders. That’s exactly what you want when you submit a hidden order!

Which could certainly be true, though those hidden order users might not have liked interacting with flow from the ColorBook router. [10]

The argument to allow IEX to favorably treat its router is pretty much the same as Levine’s point about Lava. Such treatment, if fully disclosed, would probably improve fill rates for users of both the router and IEX hidden orders. It does, however, hurt users of non-IEX routers (and non-IEX resting orders, which miss fills). The question is whether exchanges should be permitted to help their users via any means, or whether they have to consider the broader competitive landscape. Should BATS be permitted to make routing decisions based on special access to Edge’s hidden orders? The same trade-offs apply.

Regardless, IEX is perfectly capable of operating a router immune to “front-running,” without giving it preferential access. This issue is not about “front-running,” it’s about accessing hidden liquidity. [11]

Compromising

The rhetoric surrounding IEX has always been too hot for reasonable debate. That’s a shame. I think that there’s room for a compromise which allows IEX to accomplish its goals, while also satisfying automated traders and competitors. The “Flash Boys” would just have to admit that, sometimes, people who they hate make good points. Maybe that’s part of growing up. [12]

[1] This post, as always with IEX, is speculative. Their currently posted exchange application doesn’t have much information on the speed bump and when it applies. IEX’s comment letters provide more detail, but there are still some uncertainties in my mind as to what exactly their market model entails.

IEXS, the routing broker‐dealer, does not route to IEX and all orders, routable or otherwise, must pass through the POP, so there is no competitive disparity in terms of access to IEX’s trading system.

But also:

Following completion of routing actions, as instructed by the Exchange, any unfilled balance of shares returns to the Exchange for processing in accordance with applicable rules. That message does not traverse the POP

[3] IEX favorably treating its router could prompt other exchanges to create similar arrangements for their own routers, putting brokers’ smart order routers and small exchanges at a competitive disadvantage. I don’t really understand why IEX would want that to be permitted. If a larger exchange like Nasdaq were to introduce a speed bump that doesn’t apply to its router, traders would be strongly incentivized to use Nasdaq’s router, and nobody would use IEX’s. I’d think that a startup exchange would be most supportive of Reg NMS’s spirit of fair competition.

IEX’s peg order treatment could raise questions about fair competition as well. Traders and brokers may be forced to use IEX’s algorithmic order types rather than their own. Citadel expressed concern that IEX could one day “charge more to execute pegged orders… that have an inherent time advantage over other order types.” And perhaps IEX already does — by charging a higher rate for hidden orders. My understanding is that all hidden orders on IEX are effectively midpoint pegs which are repriced using non-speedbumped market data. It’s not unusual for an exchange to charge extra for hidden executions, but providing a latency advantage to hidden orders raises new questions about their fees.

[4] For example, if IEX receives a book update from Nasdaq at 10:00:00.000000 over fiber with a 1-way latency of 200us, but they know the fastest wireless link has a 1-way latency of 100us, then IEX could recalibrate the timestamp of that book update to 9:59:59.999900. That would represent the time that the fastest trader could have received the same market data message (100us earlier than IEX). There are some wrinkles when you consider that wireless links are not always operational, so if IEX were to be completely fair it would not perform this subtraction when the weather is bad. Rather than deal with that issue, it may be easier for IEX to just subscribe to wireless feeds from the most important markets. It’d probably cost a total of around $50k/mo, which doesn’t sound like a big burden.

[5] I don’t see why it should matter whether a delay has software components, but I’m also not a lawyer.

[6] Or whatever they’re calling it these days.

[8] Though I don’t understand the extent that an exchange can act in a broker-like capacity. Perhaps locating their router in a different datacenter and offering functionality similar to brokers’ smart order routers (SORs) crosses some line? If so, that still seems better than their proposal to offer systematically-advantaged SOR-like functionality?

[9] IEX seems rather dismissive of sequential routing in a comment letter (p16). But sequential routing does have its advantages. Not every user wants to fully access lit quotes without regard for market impact, price improvement, or fees.

[10] This depends on many factors, including the toxicity of ColorBook routed orders. If the information sharing between the Lava ECN and the ColorBook router were disclosed to hidden order users, they could have taken that into account before sending those hidden orders. As Levine says:

That wasn’t disclosed in its filings, or consistently disclosed in its advertising. (Though it was sometimes: This is not so much “a fact LavaFlow kept secret” as it is “a fact LavaFlow forgot to tell people.“

How consistently has IEX disclosed any favorable access it affords its router? I don’t know, but Citadel says:

While it is not explicit in the Application, IEX has explained informally that the IEX Router would not be required to go through the IEX Access Delay to access the IEX trading system or when routing orders from the IEX trading system to other market centers.

[11] There’s also an argument that allowing the IEX router to skip the speed bump guarantees that any unfilled portion of a routable order will be first in the queue when it returns to IEX. Ignoring the issue of whether IEX should be able to offer this benefit only to clients of its router, I don’t think it’s actually true. I don’t know exactly how IEX’s router works. But if it submits orders so that they hit BATS at the same time as NYSE, it should be possible for a trader to react to the sweep on BATS and submit an order to IEX more than 350us before IEX hears back from NYSE.

[12] Matt Levine is responsible for creating the pun. I’m responsible for using it badly.